How mature is your ERM program?

Whether your organization has a comprehensive enterprise risk management program in place, or you’re just in the early implementation stages, there is always room for growth. Take the Risk Maturity Model (RMM) risk management assessment to determine opportunities for improvement and actionable next steps for increasing the maturity of your risk program.

What is the RMM?

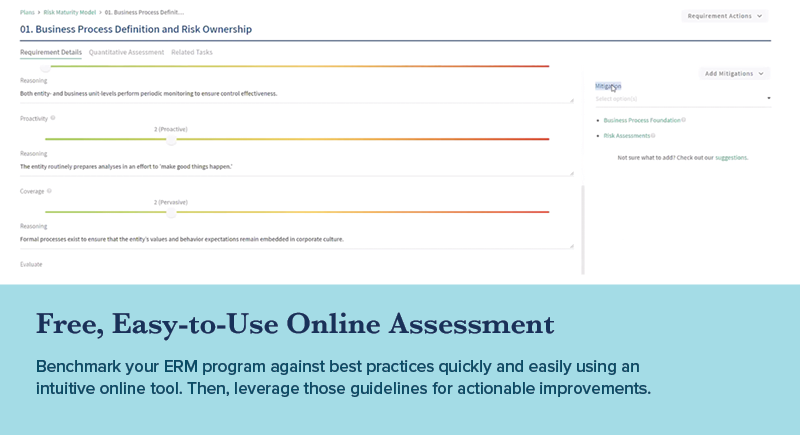

The Risk Maturity Model (RMM) is a best-practice framework for enterprise risk management. Developed as an umbrella framework of the international, cross-industry standards, a RMM risk management assessment allows organizations to measure how well their risk management efforts align with these best practices. As a result, organizations are provided a maturity score and actionable guidelines to improve their programs and gain the many benefits associated with maturity.

Benchmarking

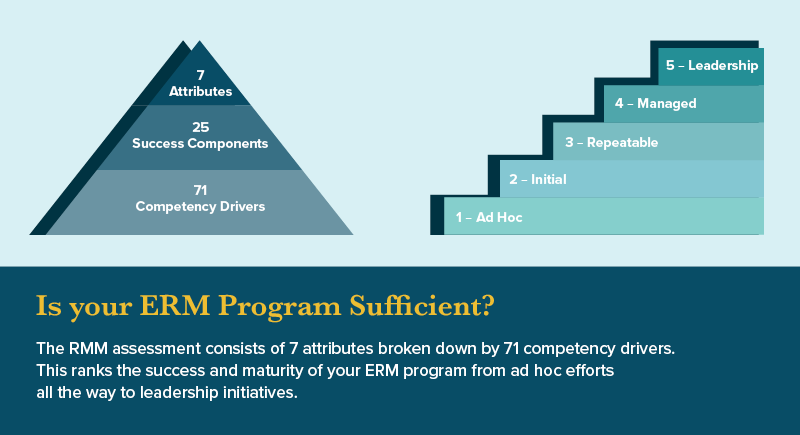

The RMM assessment takes proven best practices and breaks them into 7 attributes, 25 success components, and 71 competency drivers, identifying strong and weak areas of each program. Learn more about each RMM component here!

Resources

LogicManager is a leading provider of ERM knowledge and software. With dozens of complimentary ERM resources, including eBbooks, on-demand webinars and best practice articles, our Knowledge Center has everything ERM.

Benefits

Independent research studies on the Risk Maturity Model have proven that organizations with a higher risk maturity score have stronger financial performance, credit ratings and more effective strategic planning. Read more about the Queens University RMM study here!

Recent Risk Maturity Model Recognition Recipients

Great survey tool- will be very helpful as we begin to define, benchmark and improve our Risk Management department.

Risk Manager State Government Agency

The survey was easy to take and was very helpful in providing a qualitative measure of progress.

Chief Compliance Officer Banking

This is a very helpful exercise that just by ‘asking the right questions’ leads the participant to important insights.”